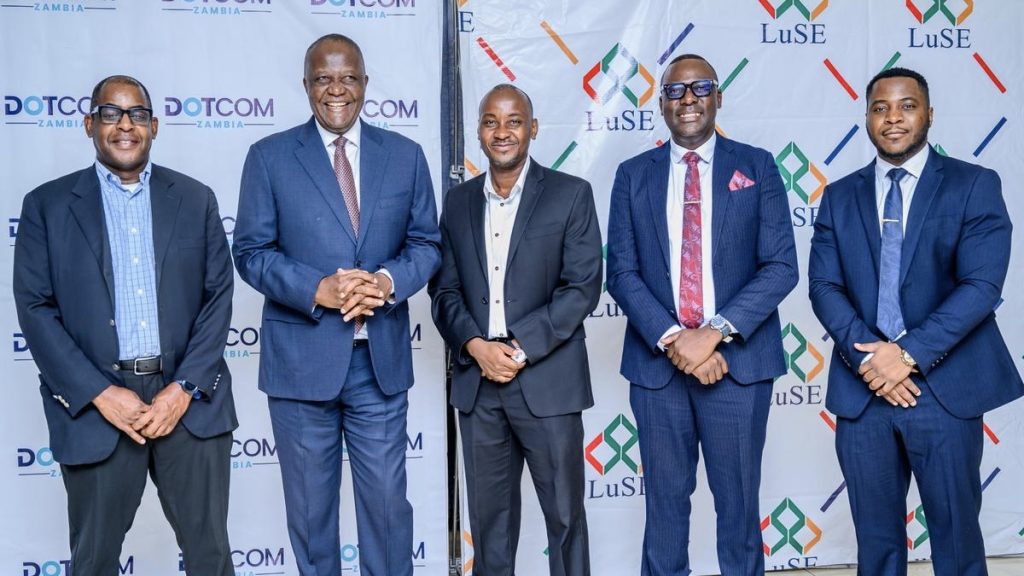

Lusaka, Zambia – December 17, 2025 Dot Com Zambia PLC’s shares have begun secondary market trading today on the Lusaka Securities Exchange Alternative Market (LuSE Alt-M), following what market intermediaries described as a record-breaking oversubscribed initial public offering (IPO) that closed early last week. The event marks a significant milestone in African tech and capital markets, positioning Dot Com Zambia as a case study for local investor participation in technology companies.

The IPO, which ran from November 27 to December 5, 2025, was oversubscribed 114 times, with retail investors accounting for most of the participation. More than 500 individual investors subscribed to the offer, reflecting strong domestic demand for equity in a home-grown technology business.

What This IPO Represents

Dot Com Zambia’s public listing is notable for several reasons. It is among the first technology-focused companies to list on the LuSE Alt-M, a market segment created to support small and medium-enterprise growth and provide accessible capital-raising options for emerging firms. The strong local demand suggests increasing confidence among individual investors in Zambia’s tech and digital services sector.

Founded in 2009, Dot Com Zambia has evolved from a regional tech startup into a diversified digital solutions provider, operating electronic tolling and digital payment platforms such as eToll and eLevy, and mobile services including ePass and eFuel, a fleet-management platform used by corporate clients and government agencies.

The company’s portfolio of digital infrastructure and payment-oriented services reflects broader trends in African tech where fintech, digital government services and transport technology have become key growth areas for startups and established innovators alike.

IPO Performance and Investor Appetite

Market reports indicate that retail investors comprised approximately 85 percent of the IPO’s subscriber base, with the remaining shares acquired by institutional and foreign investors. Zambians accounted for about 75 percent of shareholders, underlining strong local participation.

This level of participation, especially from ordinary investors, has been described by some analysts as a catalyst for deepening equity markets in Zambia and beyond. The successful IPO underscores the potential for African capital markets to channel domestic savings into productive ventures, expanding investment opportunities beyond traditional asset classes like government securities and bank deposits.

The IPO offer targeted ZMW 12.3 million (approximately USD 527,000) through the sale of one million shares at ZMW 12.30 each, representing about 10 percent of the company’s equity. Retail subscription rules allowed a broad range of individual investors to participate at relatively low minimum investment levels.

Significance for African Tech Ecosystems

While Africa’s startup funding landscape has seen fluctuations in venture capital and private funding year-to-year, public listings of technology companies remain rare. Dot Com Zambia’s entry into the public market brings visibility to nascent equity financing pathways for tech firms outside major global hubs. It also sends a signal to other African governments and capital markets that local exchanges can support technology-driven growth companies seeking public capital.

Successful retail demand for Dot Com Zambia’s shares could encourage more tech businesses in Zambia and neighboring countries to consider listing domestically, creating deeper markets for investors and broadening awareness of Africa’s tech opportunities among local institutions.

What Comes Next for Dot Com Zambia

Now trading under the ticker DCZ on the Lusaka Securities Exchange Alt-M, Dot Com Zambia will soon enter a new phase of operational and market scrutiny. Secondary trading liquidity, investor relations engagement and quarterly reporting will become central as the company balances performance with shareholder expectations.

The firm has not yet detailed how it plans to use the capital and public exposure beyond ongoing product development and scaling existing digital services, but its IPO success suggests strong momentum for growth. Analysts will watch for early trading patterns and institutional interest as indicators of broader market sentiment toward African tech listings.

Broader Implications

Dot Com Zambia’s IPO and trading debut highlight several key trends shaping African tech and investment landscapes:

- Increasing local investor engagement in technology companies

- Growth of alternative public markets for startups and SMEs

- Diversification of financing options beyond traditional VC for tech ecosystems

- Potential for more tech listings across African exchanges

The success of this IPO may also contribute to broader conversations in the region about capital market reforms, investor education, and infrastructure improvements needed to support more technology firms on public exchanges.

As Africa continues to attract global attention for its dynamic startup ecosystems, positive market events like Dot Com Zambia’s listing can reinforce confidence in local solutions and lay the groundwork for future growth of technology and innovation across the continent.